Portfolio beta calculator

Portfolio Beta 35. 09 65.

How To Calculate The Beta Of A Portfolio Youtube

Specify StockETFCryptos quantities to instantly view Portfolio Beta for timeframes calculated using recent financial data.

. Rm Market Return. 8 Promising Cryptos To Invest For Better Gains 2022. We will us the linear regression model to calculate the alpha and the beta.

R m Market Return. Beta alpha statslinregress benchmark_retvalues port_retvalues 02 print The portfolio beta is round beta 4 We can see that this portfolio had a. Get past security price for comparison benchmark.

Add up the value number of shares x share price of each stock you own and your entire portfolio. List the best pages for the search Beta Portfolio Calculator. It is a measure of the systematic risk of the portfolio.

At first we only consider the values of the last three years about 750 days of trading and a formula in Excel to calculate beta. Based on these values determine how much you have of each stock as a percentage of the overall portfolio. As a tip when calculating portfolio Beta if you have a beta that is way outside a normal range of 0-4 evaluate whether that beta number makes sense.

As mentioned in the beta calculator the beta of a stock or the beta of a portfolio is a value that measures the extra risk we take over the market risk. From a computational perspective a simple way to compute an ex-ante beta is to compute the risk of every asset in the portfolio to X. This portfolio beta template will help you calculate the weighted average beta of all of the stocks in your investment portfolio.

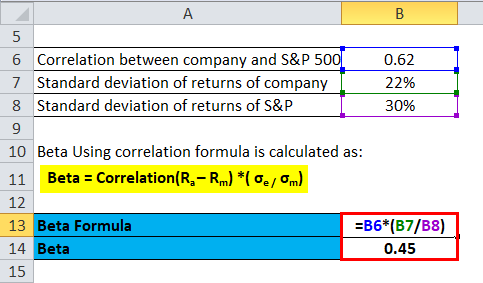

Calculation of Beta by above Beta Formula-. From the calculation above portfolio A has a greater than 100 beta. A filing with the Securities and Exchange Commission SEC that must be submitted by a company intending to file a notification of election to be subject to sections 55 through 65.

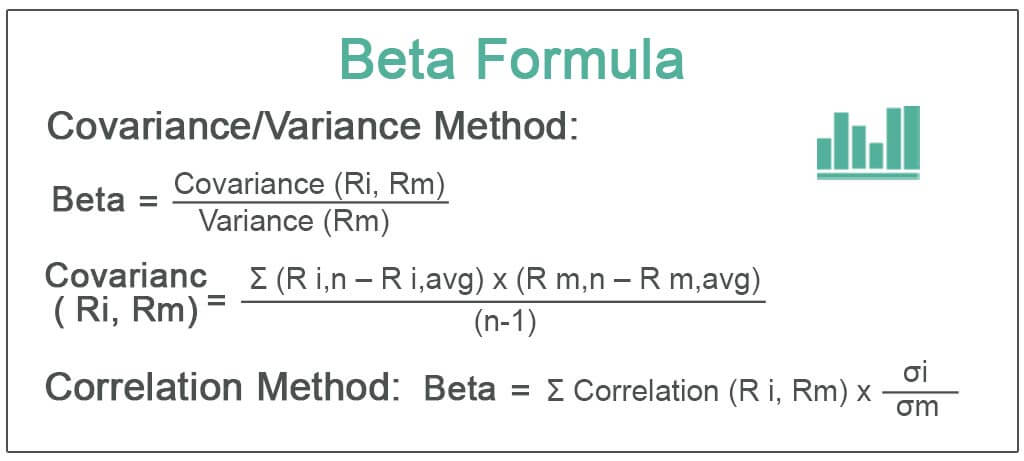

To calculate the beta of a security or portfolio we divide covariance between the return of security and market return by the variance of the market return. For most large cap stocks the Beta will be reasonably accurate though for small caps it can occasionally be significantly off. We start with a brief beta definition in stock market context.

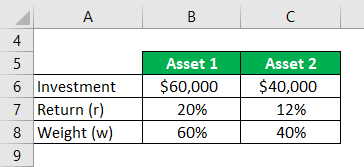

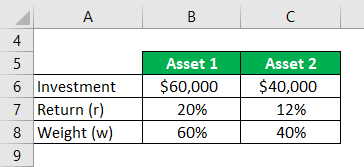

Suppose you know of five stocks and their individual stock betas and portfolio weights as follows. Apr 25 2018 We can use the regression model to calculate the portfolio beta and the portfolio alpha. It can also be refered as Capital Asset Pricing Model CAPM.

You can calculate portfolio beta for these 5 stocks using Excels SUMPRODUCT function. Beta can be calculated using above beta formula by following below steps-. Get past security price for an asset of the company.

Beta β as a measure of volatility relative to the market is an important financial metric to consider to evaluate how an investors portfolio responds to the market. Once you have the covariance between X and every asset in the portfolio you can then define the ex-ante beta to X. BETA FORMULA COVAR D1.

SEC Form N-6F. It represents the risk you cannot mitigate even by diversifying. Especially it will take a benchmark or volatility in count.

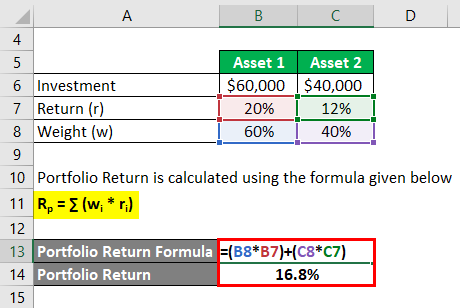

Calculate the percentage change periodically for both asset and benchmark. Where Re Stock Return. Portfolio beta is an important input in calculation of Treynors measure of a portfolio.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Aiolux automatically calculates Beta for your portfolio over different time horizons so that you dont have to. Online Portfolio Beta Calculator.

Conversely portfolio B has a beta of less than 100. Where r s Return on Security. A Detailed New Investors Trading Guide.

In contrast if the market return decrease by 10 the return of the portfolio of beta 100 would also decrease by 10. For example if 25 of your portfolio comprises of Apple and. Build Your Future With a Firm that has 85 Years of Investment Experience.

All the things about Beta Portfolio Calculator and its related information will be in your hands in just a few seconds. What Is Tether USDT. About the Calculator Features.

Take the percentage figures and multiply them with each stocks beta value. The beta calculator is an easy-to-go online tool that quickly calculates Beta Coefficient by. Thats why the beta lets you know the ratio or difference of the benchmark or volatility.

Beta is a standard measure to compare volatility with the broader market. E749 VAR E1. To do so you would call the SUMPRODUCT function and then pass in B6F6 and B7F7 as the two arrays required in the.

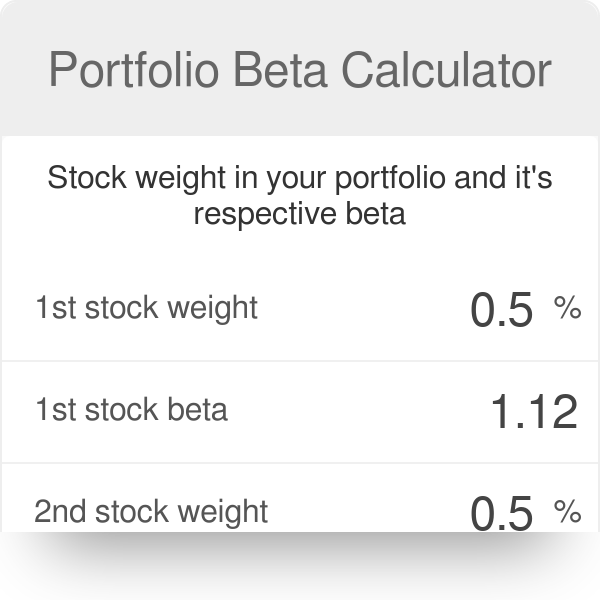

According to our calculator we now have a negative portfolio beta. Portfolio beta equals the sum of products of individual investment weights and beta coefficient of those investments. If you are investing in a companys stock then the beta allows you to understand if the price of that security has been more or less volatile than the market itself and that is a good thing to understand about a stock you are planning to add to your portfolio.

Portfolio Beta Template. The beta function is used to know the capital asset pricing model. Portfolio Beta Excel Calculation Example.

This means that portfolio A is a high risk and high return portfolio. Portfolio calculator is another important thing that you may need to run a company. We divide risk into systematic and unsystematic riskThe first relates to the intrinsic stock market risk.

Calculate The Beta Of A Portfolio In Excel The Excel Hub Youtube

How To Calculate Beta With Pictures Wikihow

Beta Formula Calculator For Beta Formula With Excel Template

Portfolio Beta Calculator

Portfolio Return Formula Calculate The Return Of Total Portfolio Example

Beta Calculator Mathcracker Com

Estimate At Completion Formula Earned Value Management Formula Pmp Exam

Portfolio Return Formula Calculator Examples With Excel Template

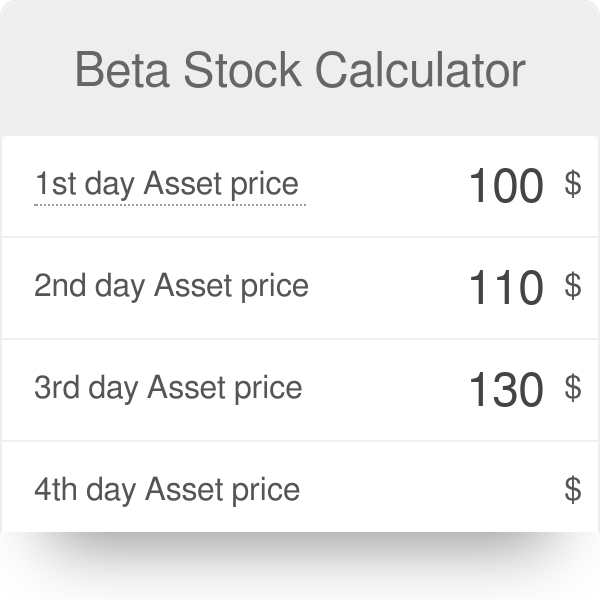

Beta Stock Calculator

Beta Formula Top 3 Methods Step By Step Examples To Calculate Beta

Portfolio Return Formula Calculator Examples With Excel Template

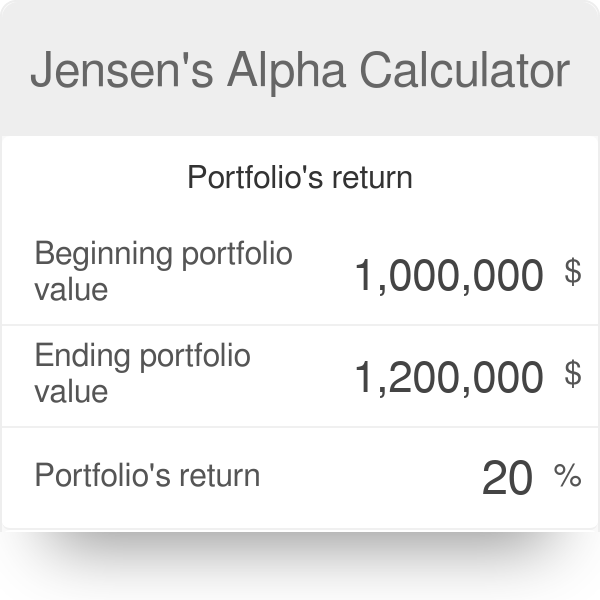

Jensen S Alpha Calculator Portfolio

Calculating Beta In Excel Portfolio Math For The Average Investor

Portfolio Beta Calculator

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

Explanation Of Alpha And Beta Investing Financial Education Investment Portfolio

Calculate Stock Beta With Excel